Why Is Managing Money So Hard? Common Pain Points and Paths to Financial Clarity

Let's be honest: managing personal finances can feel like a juggling act. From tracking daily spending and budgeting for the month, to saving for big dreams, paying down debt, and trying to grow investments, it's a complex set of tasks. No matter your age, income, or where you live, you've likely encountered frustrating hurdles along the way.

The good news? You're not alone. Many of the challenges you face are widely shared. This post explores some of the most common pain points in personal finance management, looking at why they're so tricky and what strategies people are using to cope.

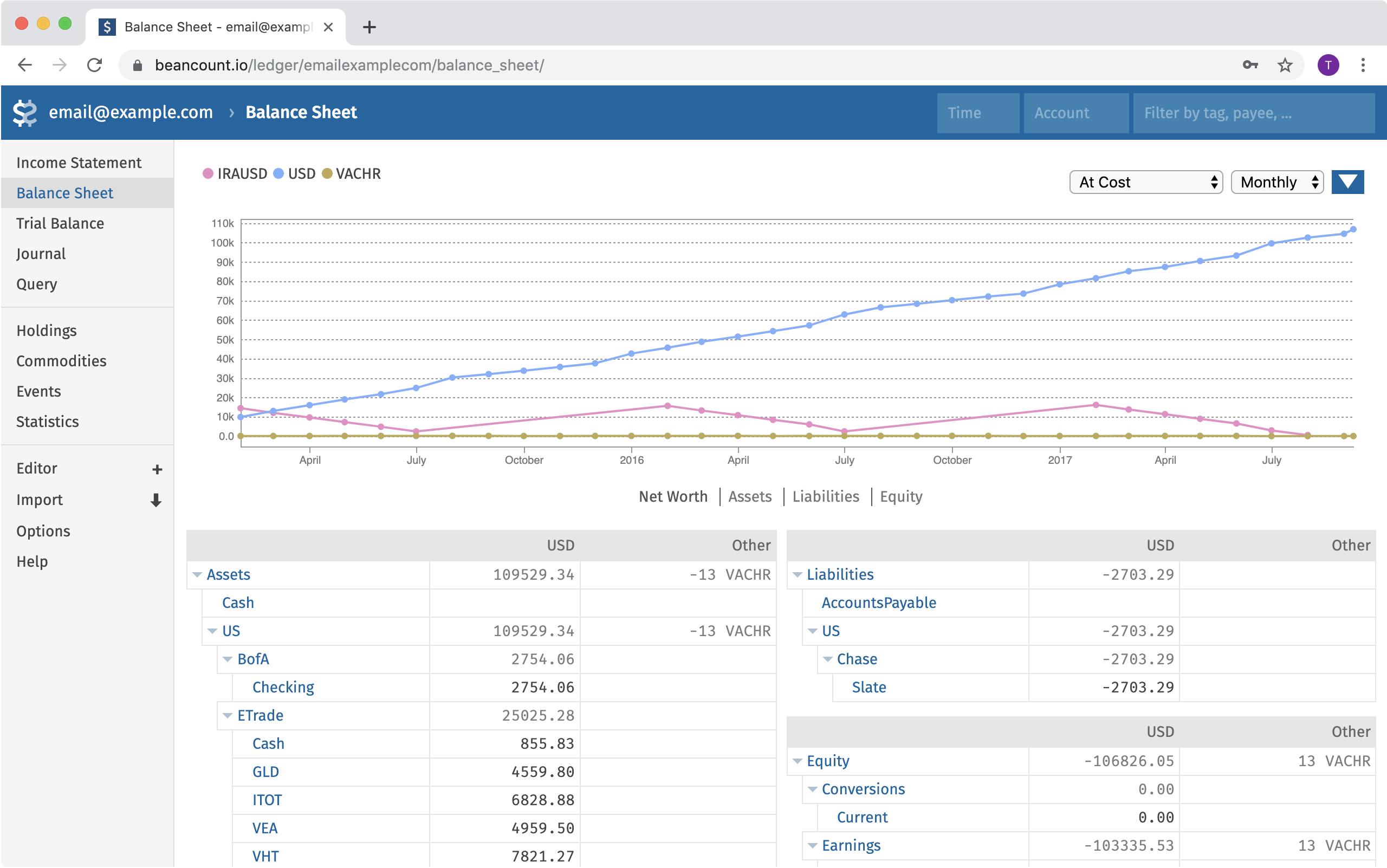

1. The Scrambled View: Seeing All Your Finances in One Place

The Pain: Your money lives in many places – a checking account here, a credit card there, a retirement fund somewhere else, maybe even a digital wallet or two. Trying to get a single, clear picture of your overall financial health by logging into multiple apps and websites is time-consuming and frustrating. This fragmentation can lead to missed details and a poor grasp of your true net worth or cash flow. Indeed, studies show over half of consumers would switch financial providers for a more holistic view.

Common Approaches:

- Aggregator Apps: Tools like Empower (formerly Personal Capital), Mint, YNAB, and Monarch promise to bring all your accounts into one dashboard.

- Bank-Provided Aggregation: Some primary banks now offer features to link and view external accounts.

- Manual Spreadsheets: Many still resort to meticulously updating a spreadsheet with balances from each account monthly.

- Logging In Individually: The old-fashioned, one-by-one check-in remains a common, albeit inefficient, habit.

Why It's Still Tough: Despite these solutions, users frequently complain about broken connections requiring re-authentication, incomplete coverage (niche accounts like small regional banks or crypto wallets often don't sync), and data delays. Privacy concerns also prevent some from linking accounts, as over half of people haven't consolidated their accounts digitally due to trust or knowledge gaps.

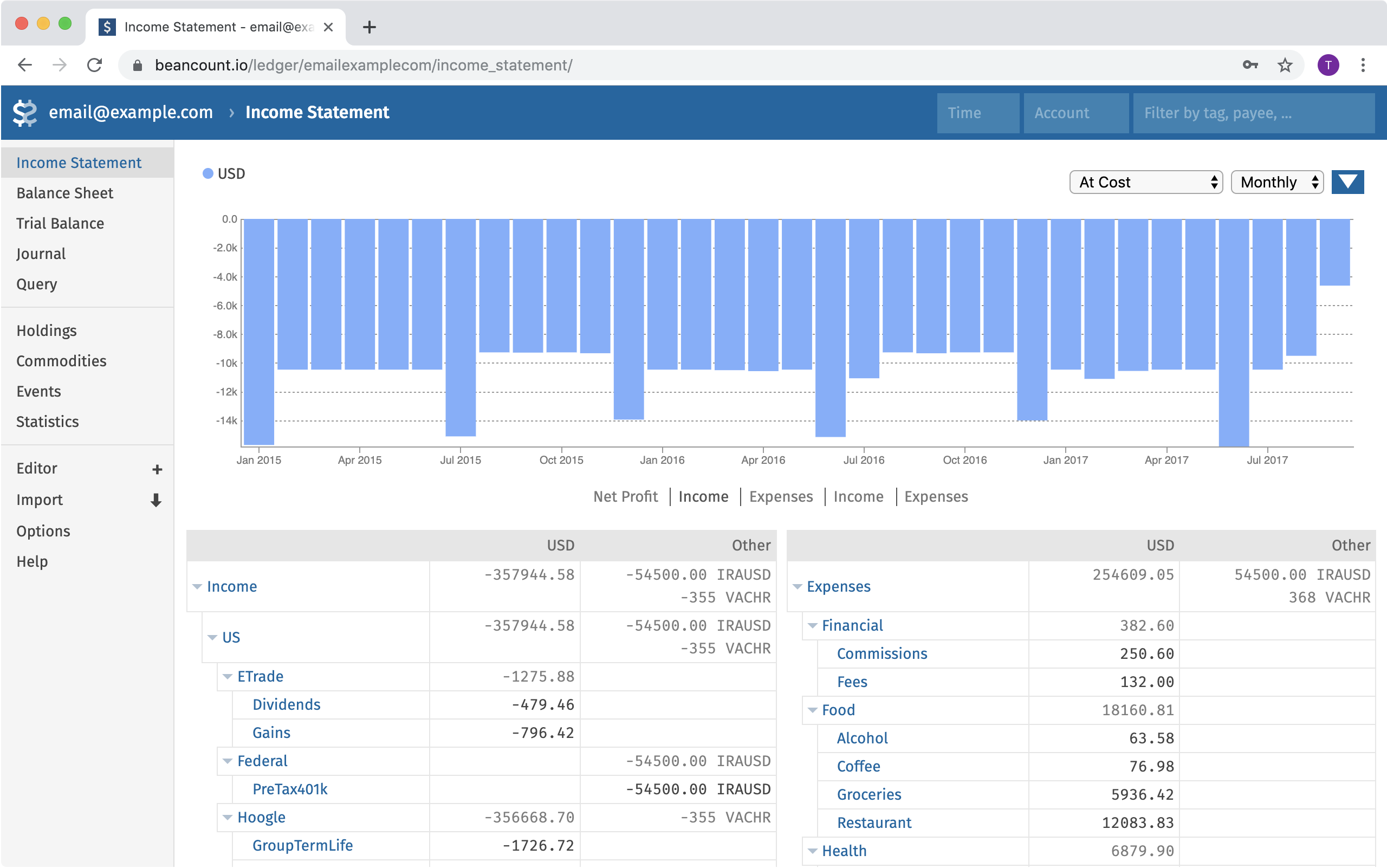

2. The Budgeting Battle: Creating and Sticking to a Plan

The Pain: Setting spending limits and actually adhering to them is a classic challenge. Nearly two in five Americans have never had a formal budget, and many who try struggle to maintain it. This can lead to overspending, debt, and anxiety. The pain often stems from budgets feeling restrictive, unexpected expenses derailing plans, or a lack of knowledge on how to create a realistic budget, especially with volatile incomes.

Common Approaches:

- Budgeting Apps: YNAB (You Need A Budget), Mint, Simplifi, and PocketGuard offer various methodologies, from zero-based budgeting to automated tracking with spending alerts.

- Spreadsheets: A go-to for those who want total customization, with about 40% of budgeters using them.

- Cash Envelope Method: A tangible way to control spending by allocating physical cash to envelopes for different expense categories.

- Automated Rules: "Pay yourself first" by auto-transferring to savings, or automating bill payments and spending what's left.

- Financial Coaching & Online Communities: Seeking expert advice or peer support on platforms like Reddit for motivation and tips.

Why It's Still Tough: Budgeting is as much a behavioral challenge as a financial one. Temptation, lifestyle creep, and a lack of financial literacy can undermine even the best intentions. Many apps enforce a specific methodology that doesn't suit everyone, and inaccurate automatic transaction categorization creates tedious manual work.

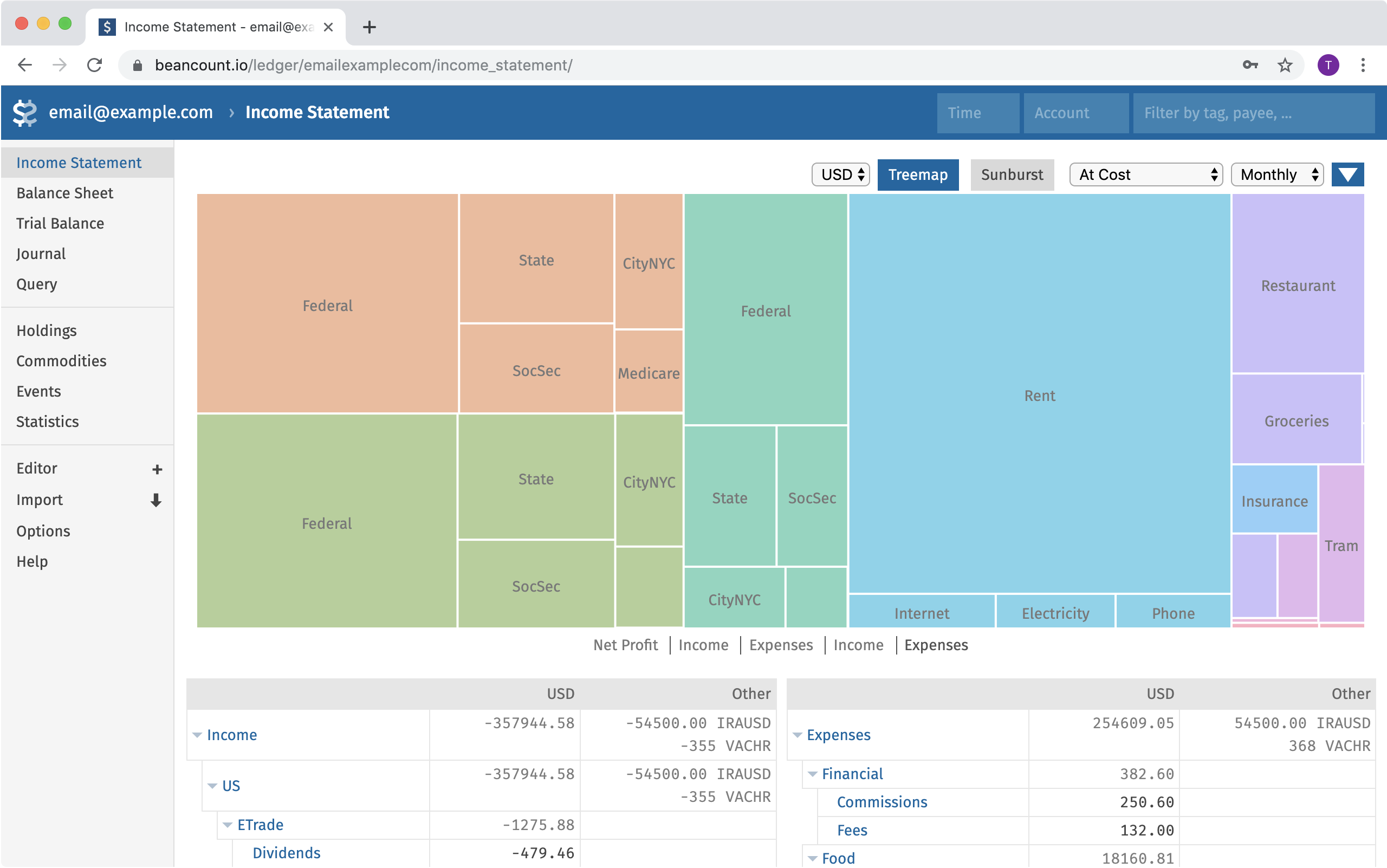

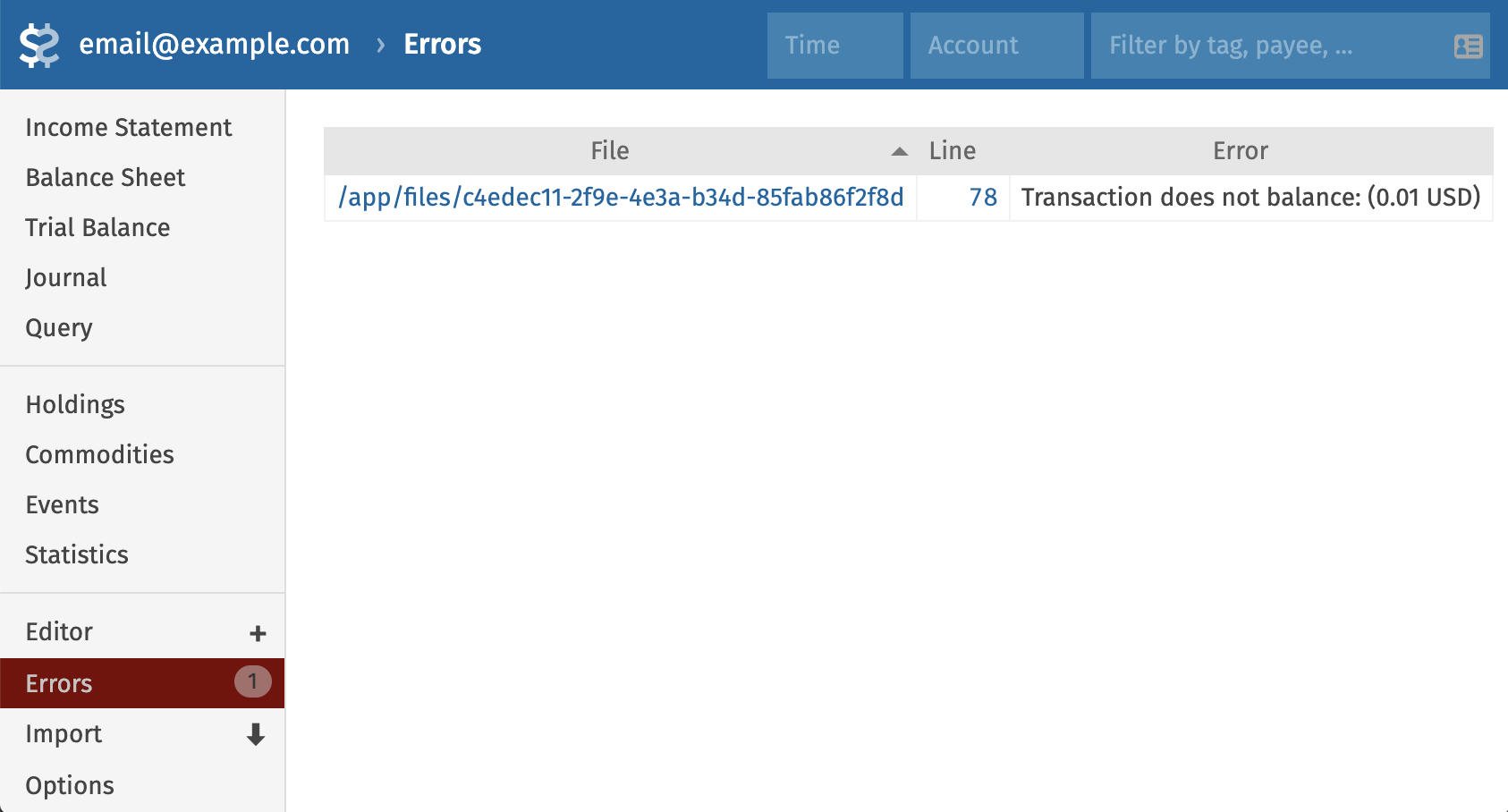

3. The Mystery of the Missing Money: Tracking Income and Spending

The Pain: Do you ever get to the end of the month and wonder where a significant chunk of your money went? You're not alone; about 59% of Americans don't track spending regularly. The challenge lies in consistently recording all transactions, especially cash purchases, and categorizing them meaningfully to understand spending habits.

Common Approaches:

- Personal Finance Apps: Most budgeting apps also track expenses by auto-importing transactions from linked bank and card accounts.

- Manual Logs: Using journals, simple expense tracker apps, or even the Japanese Kakeibo method to meticulously record each outlay.

- Periodic Reviews: Instead of daily tracking, some review bank and credit card statements weekly or monthly.

- Specialized Tools: Apps like Expensify for business receipts or subscription trackers for recurring charges.

Why It's Still Tough: Automated categorization is often inaccurate, forcing users to constantly make corrections—a common complaint among Mint users, for example. Cash spending is easily forgotten and rarely captured by apps unless manually entered. Real-time feedback is often lacking, meaning insights arrive too late to influence behavior for that month.

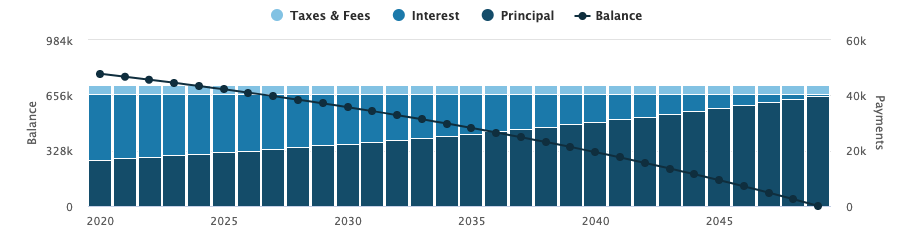

4. The Debt Dilemma: Strategies for Repayment

The Pain: Managing and reducing debt—be it from credit cards, student loans, or personal loans—is a major source of stress. High interest rates can make it feel like you're running on a treadmill, with much of your payment going to interest rather than principal. In fact, heading into 2025, reducing debt was the top financial goal for 21% of Americans.

Common Approaches:

- Debt Payoff Planning Tools: Apps like Debt Payoff Planner or Undebt.it help visualize payoff schedules using strategies like the debt snowball (paying smallest balances first) or avalanche (highest interest first).

- Consolidation and Refinancing: Taking out a new, lower-interest loan or using a 0% APR balance-transfer credit card to combine multiple debts.

- Manual Strategy Application: Adopting the snowball or avalanche method using spreadsheets or simple lists.

- Automated Extra Payments & Round-Ups: Setting up automatic additional payments or using apps that apply spare change from purchases towards debt.

- Support Communities: Online forums where people share progress and find motivation.

Why It's Still Tough: Many users struggle with understanding how interest accrues. Staying motivated over a long payoff journey is difficult. Existing tools often don't seamlessly integrate debt strategy with overall budgeting, nor do they offer sufficiently personalized advice or robust motivational feedback.

5. The Big Goal Hurdle: Saving for a Large Purchase

The Pain: Saving for a significant purchase like a home, car, or wedding requires discipline over months or even years. It’s challenging to consistently set aside large sums while balancing daily life and resisting the temptation to dip into those savings.

Common Approaches:

- Dedicated Savings Accounts: Opening separate accounts labeled for specific goals (e.g., "House Fund"). Many online banks offer "buckets" or "pots" for this.

- Automation: Setting up automatic transfers from checking to goal-specific savings accounts each payday.

- Goal-Tracking Apps: Some finance apps allow setting targets and visualizing progress.

- Community Saving Strategies: Informal groups like Rotating Savings and Credit Associations (ROSCAs) are common in some cultures.

- Using Illiquid Forms: Temporarily locking money into short-term CDs or bonds to prevent easy access.

Why It's Still Tough: Maintaining discipline for delayed gratification is hard. Tools often don't integrate goal saving well with monthly budgets or dynamically adjust plans if you fall behind. Managing shared goals with a partner can also be tricky with existing app limitations.

6. The Partner Puzzle: Managing Money with Someone Else

The Pain: Combining finances with a partner, spouse, or even roommate introduces complexities in coordinating budgets, dividing responsibilities, maintaining transparency, and avoiding conflict. Financial disagreements are a leading cause of relationship stress.

Common Approaches:

- Joint Accounts & Shared Cards: A common method for handling shared household expenses. Often used in a "yours, mine, ours" system with separate personal accounts.

- Expense-Sharing Apps: Tools like Honeydue, Tandem, or Splitwise are designed to help couples or groups track shared expenses and settle up.

- Spreadsheets and Regular "Money Dates": Periodically reviewing finances together to discuss spending, bills, and goals.

- Division of Labor & Allowances: Assigning specific financial tasks to each partner or allocating personal spending money to reduce conflict.

Why It'S Still Tough: Most finance apps are designed for single users. Finding a system that feels fair and transparent to both individuals, especially with differing money personalities or incomes, is a persistent challenge. Tools often lack granular privacy controls or features to facilitate better financial communication beyond just sharing numbers.

7. The Investment Maze: Tracking and Understanding Your Portfolio

The Pain: As wealth grows, so does the complexity of tracking diverse investments like stocks, bonds, retirement accounts, and crypto spread across multiple platforms. Understanding overall performance, asset allocation, and tax implications can be overwhelming.

Common Approaches:

- Portfolio Aggregator Apps: Services like Empower (Personal Capital) or Kubera aim to consolidate investment data from various accounts.

- Brokerage Consolidation: Minimizing the number of platforms by rolling over old accounts to a single brokerage.

- DIY Spreadsheets: Using tools like Google Sheets with functions (e.g., GOOGLEFINANCE) to manually track holdings and performance.

- Robo-Advisors: Relying on the dashboards provided by automated investment services.

- Specialized Trackers: Tools like Sharesight for detailed performance including dividends, or CoinTracker for crypto.

Why It's Still Tough: No single tool perfectly aggregates every asset type automatically. Calculating true investment performance (factoring in contributions, dividends, fees) is complex. Many tools either oversimplify or overwhelm users with data, and often lack clear educational components or goal integration.

Towards Financial Clarity

Managing personal finances is an ongoing journey filled with potential pitfalls. While technology offers an ever-increasing array of tools, the core challenges often lie in behavior, knowledge, and finding systems that truly fit individual and shared lives. By understanding these common pain points, we can better identify strategies and seek out or advocate for solutions that bring greater clarity, confidence, and control over our financial well-being. The landscape of financial tools is constantly evolving, hopefully leading to more intuitive, integrated, and genuinely helpful ways to navigate our money.